Experience the

DBE Difference

We help Financial Institutions solve problems, achieve goals and improve business operations through technology.

let's get started view solutions200+

DBE Team Members

4,500+

Valued Clients

3,500+

ATMs + ITMS

1,300+

Teller Cash Recyclers

Serving Financial Institutions For Over 50 Years

Best in Class Solutions

We represent global industry leaders in their product categories and support the solutions ourselves, ensuring we deliver the best possible solutions and outcomes for our clients.

Innovation Leader

Globally recognized for our commitment to Innovation, DBE invests in new ways for our clients to improve their businesses through technology.

Ongoing Support

We’ll help you plan for integrating new technology and provide support through the life of the product.

How We Can Help

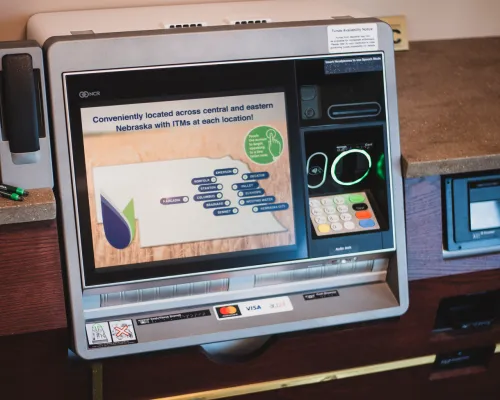

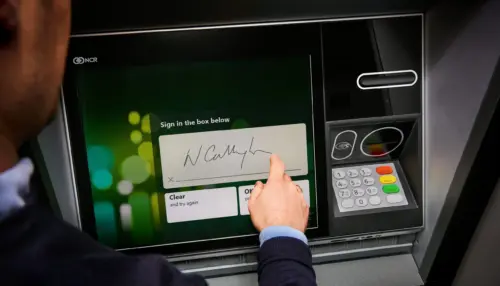

ATM + ITM

ATM + ITM

The Self-Service Channel is evolving. Unlock the strategic potential and get more out of your ATM + ITM investments with DBE.

Learn More About ATM + ITMsTeller Cash Recyclers

Teller Cash Recyclers

Automate currency transactions and transform your branch experience with Teller Cash Recycling Technology from DBE.

Learn More About Teller Cash RecyclersEncompass Service Delivery

Encompass Service Delivery

Learn how DBE encompasses our client's fleet with 360-degree coverage. Through onsite and remote service, we eliminate costly gaps in coverage and improve uptime while providing additional value add solutions.

Learn More About Encompass Service DeliveryElevate, Self-Service Channel Marketing

Elevate, Self-Service Channel Marketing

Elevate, Dynamic Self-Service Channel Marketing SaaS, is exclusively hosted and supported by DBE. Elevate your Self-Service Channel experience by distributing broad, BIN based and terminal segmented marketing campaigns and offering transaction preferences and E-Receipts.

Learn More About ElevateCoin & Currency Solutions

Coin & Currency Solutions

DBE supplies the leading currency and coin counting technology from our global partners.

Learn More About Coin & Currency SolutionsDeployment, Training & Integrations

Deployment, Training & Integrations

We know a solution will only be as successful as how it's planned for, implemented and trained. Learn how DBE does it better.

Learn More About DBE's Professional ServicesHow We Can Help

DBE Helps Financial Institutions Solve Problems

Staffing Challenges

In today's economic and labor environment, Financial Institutions need to do more with less. DBE can help.

Learn MoreModernizing Branch Experience

DBE helps Community Financial Institutions modernize to meet the needs of today's consumer and position for the future.

learn moreImproving Client & Employee Engagement

We help Financial Institutions create memorable consumer and employee experiences through technology.

learn more

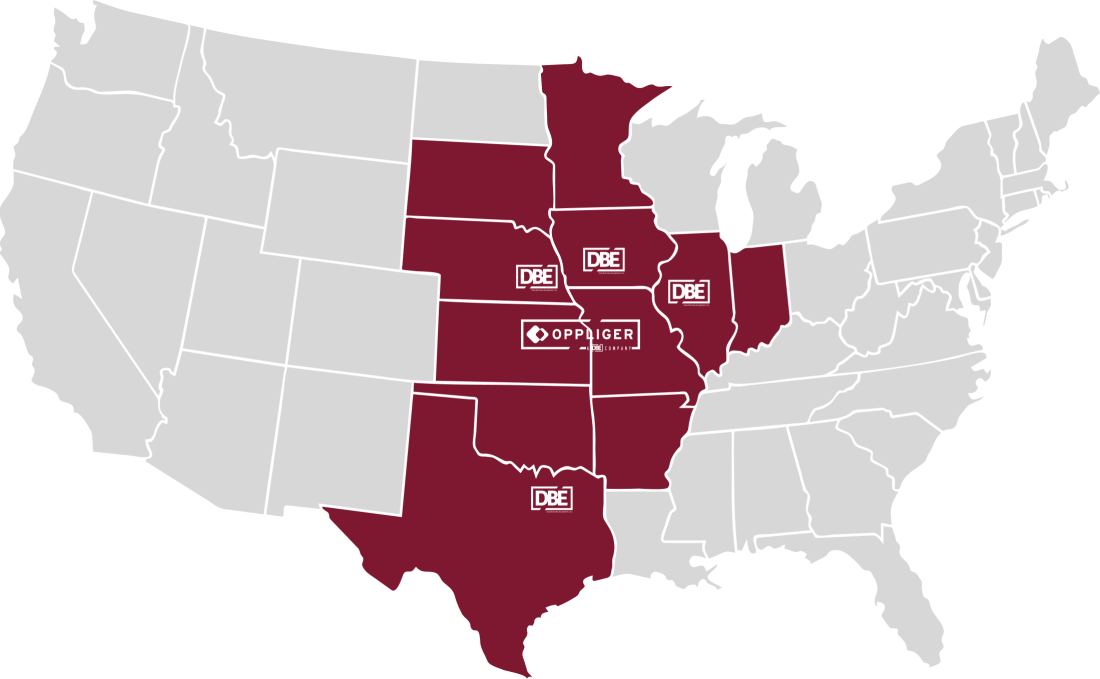

We've Got You Covered

DBE is ready to serve your Financial Institution with over 200 employees including more than 100 field technicians. Independently owned since 1968, DBE's coverage has grown significantly through strategic acquisition and organic growth fueled by our satisfied clients.

support portal